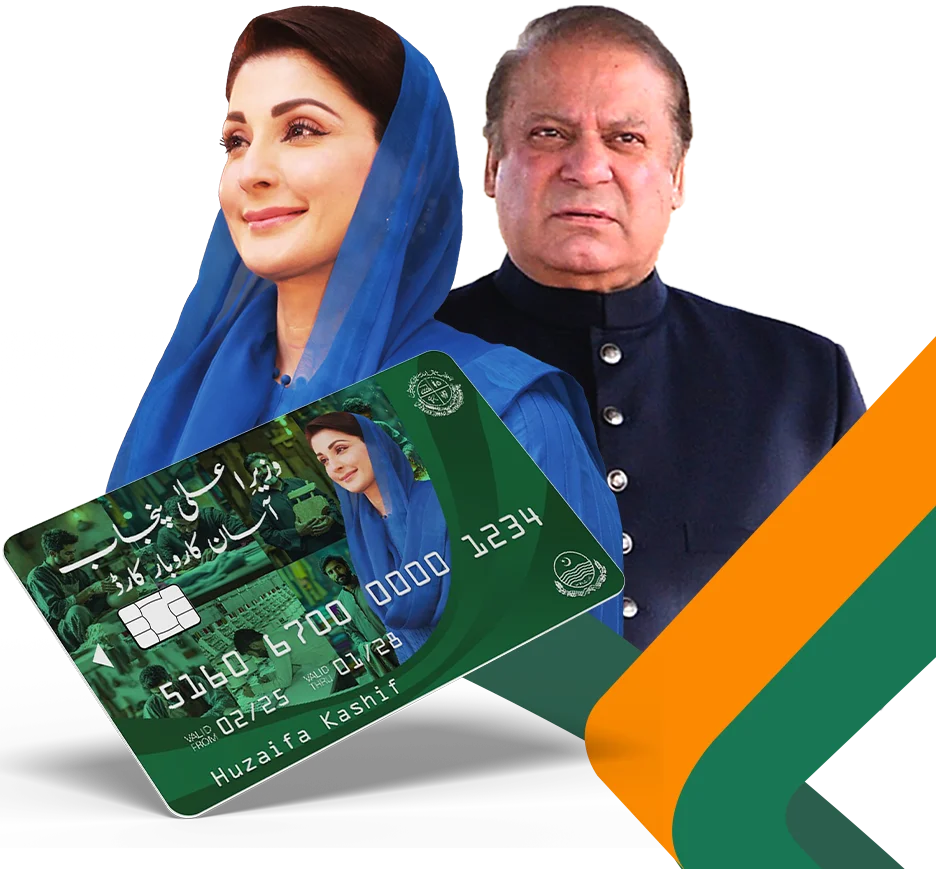

Introduction to Asaan Karobar Card

The Asaan Karobar Card is designed for entrepreneurs and small business owners looking for a simple, efficient way to manage business finances. This innovative card offers easy credit facilities and flexible repayment plans, empowering businesses to grow by accessing funds quickly and securely.

Key Features and Benefits

- Easy Application Process: The application is straightforward, helping business owners get approved rapidly.

- Flexible Repayment Options: Repayment plans are designed to suit various business cash flow situations.

- Credit Building Opportunity: Regular usage can help build and maintain a positive business credit score.

- Minimal Processing Fees: The cost of applying and maintaining the card is kept at an affordable level.

The card is not only a modern financial tool but also serves as a stepping stone for businesses to scale their operations.

How to Apply for Asaan Karobar Card

- Online Application:

Visit the official website or the designated portal where you can fill out a simple online form. - Document Submission:

Submit required documents such as business registration, identification, and financial statements. - Approval and Activation:

Upon meeting eligibility criteria, your application will be reviewed. Once approved, you will receive your Asaan Karobar Card along with clear instructions for activation.

Important Information and Calculations

Below is a table that outlines the essential details about the Asaan Karobar Card, including sample calculations to demonstrate fee and repayment scenarios.

| Category | Detail | Calculation/Example |

|---|---|---|

| Processing Fee | A small percentage of the approved amount is charged as a processing fee. | For a loan of Rs. 100,000, if the fee is 2%, then Fee = Rs. 100,000 x 0.02 = Rs. 2,000. |

| Annual Interest Rate | Interest is charged annually based on the outstanding amount. | For an outstanding balance of Rs. 50,000 at an interest rate of 10%, then Annual Interest = Rs. 50,000 x 0.10 = Rs. 5,000 per year. |

| Repayment Period | Flexible repayment periods that can be chosen based on business needs, ranging from a few months to several years. | If you choose a 12-month plan for Rs. 100,000, then Monthly repayment = Rs. 100,000 / 12 ≈ Rs. 8,333 (not including interest). |

| Late Payment Fees | A nominal fee applied in case of delayed repayments to ensure timely payments and maintain a healthy credit record. | Late fee might be a flat rate such as Rs. 500 per late payment, encouraging on-time repayments and avoiding extra charges. |

| Credit Limit | The maximum limit allocated to the card based on business performance and credit history. | For a new business, the limit might start at Rs. 150,000, while established businesses may receive higher limits after a credit review and based on financial performance metrics. |

Each calculation is provided in simple terms to help you understand how the costs and fees add up when using the Asaan Karobar Card.

FAQs

- What is the Asaan Karobar Card?

It is a business credit card designed to provide easy access to funds and flexible repayment options. - Who can apply for the Asaan Karobar Card?

Registered small and medium business owners can apply for the card. - What are the main benefits of using the card?

It offers easy credit access, flexible repayment plans, and helps in building a business credit score. - How do I apply for the card?

Applications can be submitted online or at designated bank branches with required documentation. - Are there any fees associated with the card?

Yes, a small processing fee and other nominal charges apply as part of the card usage.

Conclusion

The Asaan Karobar Card is a powerful tool for business owners looking to streamline their finances and access necessary capital without complicated procedures. With its simple application process, clear fee structure, and flexible repayment options, this card provides an excellent opportunity for businesses to enhance their financial health and growth potential. Whether you are starting out or looking to expand your existing enterprise, the Asaan Karobar Card offers the right support to meet your business needs.